louisiana state inheritance tax

Louisiana does not impose any state inheritance or estate taxes. Louisiana inheritance and gift tax.

Louisiana Estate Tax Everything You Need To Know Smartasset

That is becasue an inheritance tax is a tax on the person who inherits the property not the estate itself.

. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. There are also local taxes of up to 6. Louisiana does not have an inheritance tax.

Third and even more importantly for Louisiana residents if your estate is not structured correctly the property in your estate may be subject to the INCOME tax by foreging the step up in basis at death. Well focus on the Louisiana components first and then the federal components. An inheritance tax is a tax imposed on someone who inherits money from a deceased person.

The inheritance could be money or property. Its also a community property estate meaning it considers all the assets of a married couple jointly owned. The 5 million exemption will return for deaths occurring in 2026 and thereafter unless congress votes to extend the larger exemption.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Louisiana state inheritance tax Thursday March 3 2022 Edit. An heirs inheritance will be subject to a state inheritance tax only if two conditions are met.

Estate tax of 08 percent to 16 percent on estates above 16 million. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Impose estate taxes and six impose inheritance taxes.

Louisiana collects an inheritance tax. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. Happily I can report they.

1 total state death tax credit allowable per us. Louisiana no longer has either a state gift tax or a state estate tax. If the total estate asset property cash etc is over 5430000 it is subject to the federal estate tax form 706.

The federal gift tax exemption is 15000 per year for each gift recipient. The Louisiana aspects to gift and estate tax are pretty simple. Iowa doesnt impose an inheritance tax on beneficiaries of estates.

The Act also provided that inheritance taxes due to the state for deaths occurring before July 1 2004 shall be considered due on January 1 2008 if no inheritance tax return was filed before January 1 2008 and the inheritance tax shall prescribe as provided by Louisiana Constitution Article 7 Section 16 in three years from December 31. When a person dies and leaves an inheritance the state must tax the wealth before the beneficiary collects their shares. Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death.

However according to the federal estate tax law there is no Louisiana inheritance tax. It operates almost like an. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur after December 31 2004. An inheritance tax is levied upon an individuals estate at death or upon the assets transferred from the decedents estate to their heirs. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Unlike estate taxes inheritance tax exemptions apply to the size of the gift rather than the size of the estate. Estate tax of 306 percent to 16 percent for estates above 59 million. Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax.

You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. Total inheritance tax Forward to Line 4 Schedule IV Total due or refund due From Line 6 Schedule V 1401 Mail Date Schedule I Recapitulation of Detailed Descriptive List or Inventory Schedule II Preliminary Distribution and Calculation of Usufruct Schedule III Determination of Louisiana Inheritance Tax. As the only.

If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. The federal estate tax exemption is. Inheritance tax of up to 16 percent.

Louisiana Estate Tax Everything You Need To Know Smartasset The second round of. The Louisiana inheritance tax was repealed effective Jan. Inheritance tax of up to 15 percent.

The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. Thus there is no requirement to file a return with the State and no state inheritance taxes are owed. The state where you live is irrelevant.

Maximum allowable state tax credit 12400 Louisianas estate transfer tax With the transfer tax in place the 185000 is split between Louisiana and the IRS 12400 to Louisiana and 172600 to the IRS If Louisiana had no estate transfer tax the estate would pay the entire 185000 to the IRS. That is becasue an inheritance tax is a tax on the person who inherits the property not the. This is what I call the hidden estate tax.

Louisiana collects a 4 state sales tax rate on the. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. Louisiana does not impose any state inheritance or estate taxes.

If you own property in Louisiana and pass it on as inheritance then the beneficiary will not be obligated to pay. 619 Iowa policymakers set the state on course to eliminate the inheritance tax by the first day of 2025. For instance Kentuckys inheritance tax applies to any property in the state even if the inheritor lives out of state.

With the changes to the Federal Estate tax which took effect this year I have been asked by numerous clients if the Louisiana Inheritance Tax laws were changed in any way. There is no louisiana inheritance tax for people who die after june 30 2004. Theres been a big change to the estate and gift tax rules for 2018.

Louisiana Inheritance and Gift Tax. Estate tax of 10 percent to 16 percent on estates above 1 million. Louisiana no longer has either a state gift tax or a state estate tax.

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Estate Tax Planning Vicknair Law Firm

Louisiana Succession Taxes Scott Vicknair Law

Louisiana Renunciation Of Unopened Succession Louisiana Succession Us Legal Forms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Health Legal And End Of Life Resources Everplans

Where S My State Refund Track Your Refund In Every State Taxact Blog

Louisiana Small Succession Fill Out Printable Pdf Forms Online

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Inheritance Tax Estate Tax And Gift Tax

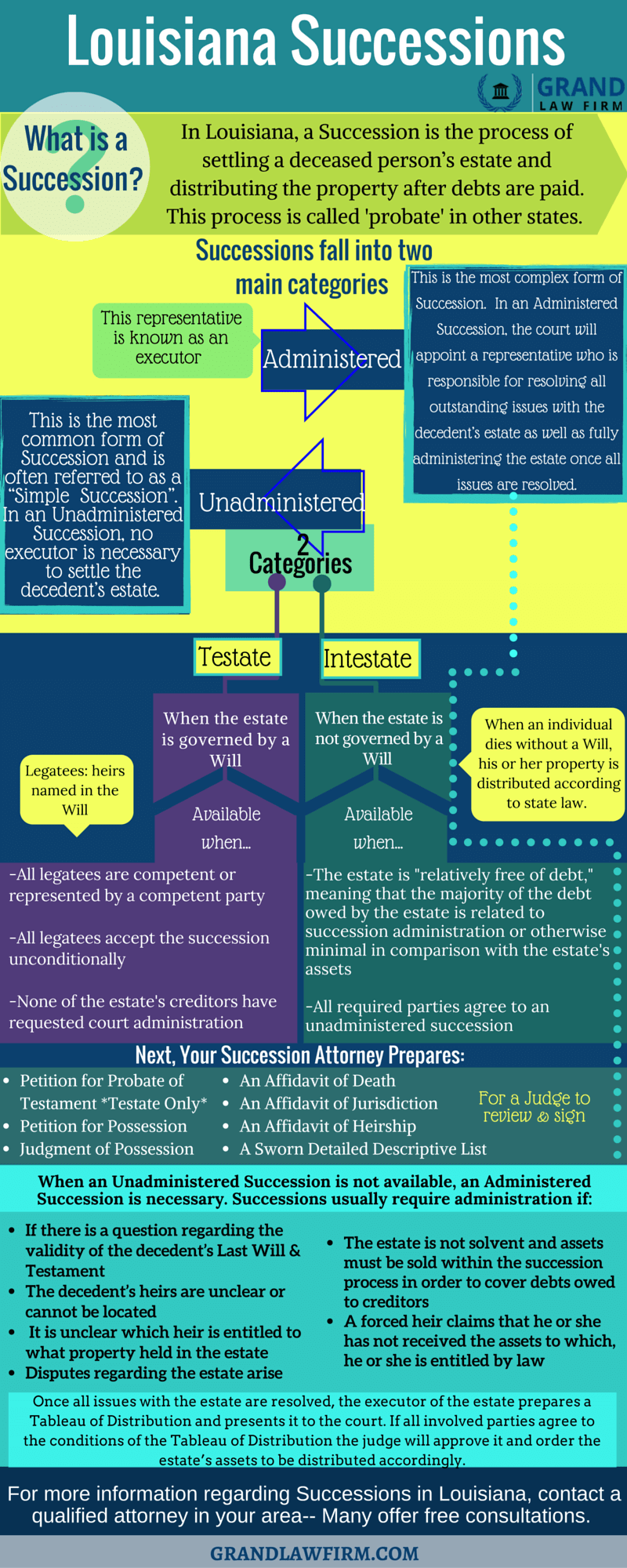

Louisiana Successions A Brief Explanation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Historical Louisiana Tax Policy Information Ballotpedia